We provide personalized service and advice tailored to your needs and objectives.

Most of our new clients come by way of word-of-mouth referrals from leading venture capital, accounting, and law firms, and from our current and past customers. They recommend us for our expertise, reliability, responsiveness, and value. We have earned a reputation for minimizing the impact on management’s time and effort.

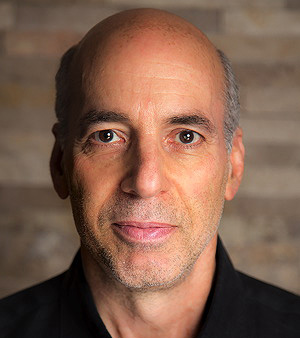

Timan’s Founder & CEO Joshua Sommer is a technology startup entrepreneur and a financial instruments expert. He founded three successful software companies, has worked on Wall Street, and has been a COO and CFO for long periods of his career. Joshua is also an investor in numerous VC and PE funds and private startups. He holds a BA degree from the University of Virginia and earned his MBA from the Stanford Graduate School of Business.

Vice President Victor Gilberti is a financial advisory expert and an experienced startup entrepreneur. He was Managing Director of an SEC Registered investment advisory firm and has been a fee only financial advisor to individuals and small businesses as well as a court appointed estate executor. Victor holds BS and MS degrees from MIT and an MBA from the Stanford Graduate School of Business.

Vice President Lampros Fatsis is a CFA charterholder and an organizational consultant. He has over 20 years’ experience as an investment analyst doing valuations of both private and public companies and has completed over 500 Timan valuation engagements. Lampros holds a BS degree in Ship Design, an MS in Engineering, and an MS in Systems Management, all from MIT.

Vice President Simon Sakamoto is an equity valuation analyst for Timan LLC. He has completed hundreds of engagements for VC backed and other private companies performing business valuations. He has worked with startups from earliest stages through exits, including the S-1 filing in process. Prior experience includes buy-side portfolio management for a REIT and bank portfolios, and developing fixed income trading businesses for First Boston and Shearson Lehman Brothers.

Simon holds a BS degree in Electrical Engineering from MIT and an MBA from the Columbia University Graduate School of Business.

Senior Analyst Raghu Kotrike is a CFA charterholder with over 14 years’ experience in corporate finance and valuation. At Deloitte Valuation Services in Boston and San Jose, he reviewed over 1,000 409A valuations and performed valuations for complex derivatives, IP, and business combinations. Raghu holds a BS degree in Electrical Engineering, an MBA, and an MS in Finance from the University of Rochester Simon Graduate School of Business.